year end tax planning strategies

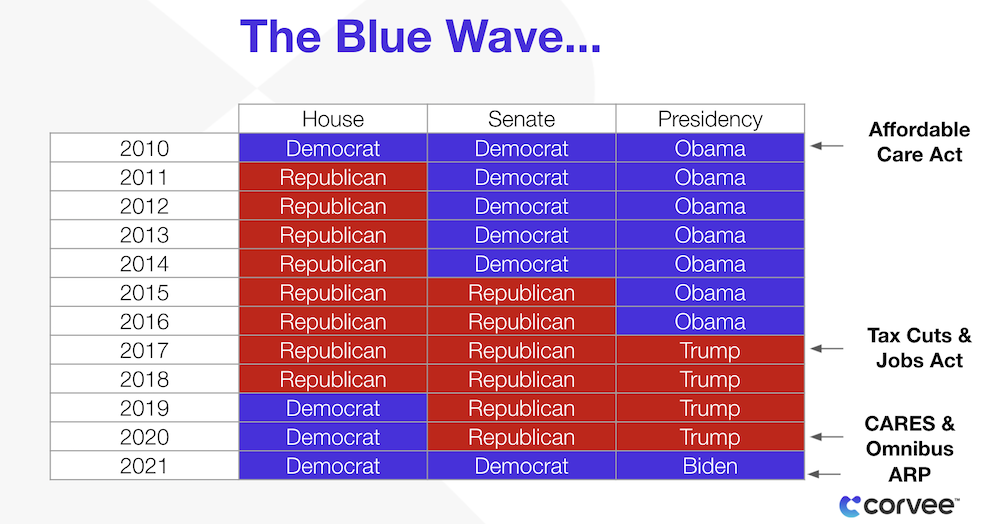

Tax rules that took effect in 2018 as a result of the Tax Cuts and Jobs Act of 2017 brought about multiple changes for individual tax filers. While every clients situation.

Top 6 Year End Tax Planning Tips

Contact a Fidelity Advisor.

. Join Sikich tax experts in our one-hour webinar where we will cover the following. Weekly Round Up - Oct 9 - 15. Suggested tax changes include.

By Retirement Daily Guest Contributor Oct 17 2022 700 AM EDT. By Retirement Daily Oct 14. As 2022 comes to a close there are many tax issues to be aware of.

Tax Planning Strategies for Individuals. Personal income over 150000 is taxed at. Year-End Tax Planning Strategies.

Accelerate payment of deferred payroll taxes. 2021 has been an interesting year for our. Late November through year end is the time for year-end tax planning.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Leading Federal Tax Law Reference Guides. 7 Tax Planning Strategies For Companies.

If the answer is yes then you NEED to join me on November 16 2021 from 1100 am to 1230 pm on my Year-End Tax Planning Strategies FREE WEBINAR. Year-End Tax Planning Strategies. Is Advanced Tax Advisors founder.

Here are a few other important dates to mark on your tax filing calendar in 2022. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Tax-loss harvesting is a strategy to lower your capital gains tax.

Wide Range of Investment Choices Access to Smart Tools Objective Research and More. The best year-end tax strategies from top-ranked advisors including a once in a multiple-decade opportunity Published Tue Oct 11 2022 900 AM EDT Updated Tue Oct 11. Selected changes from the.

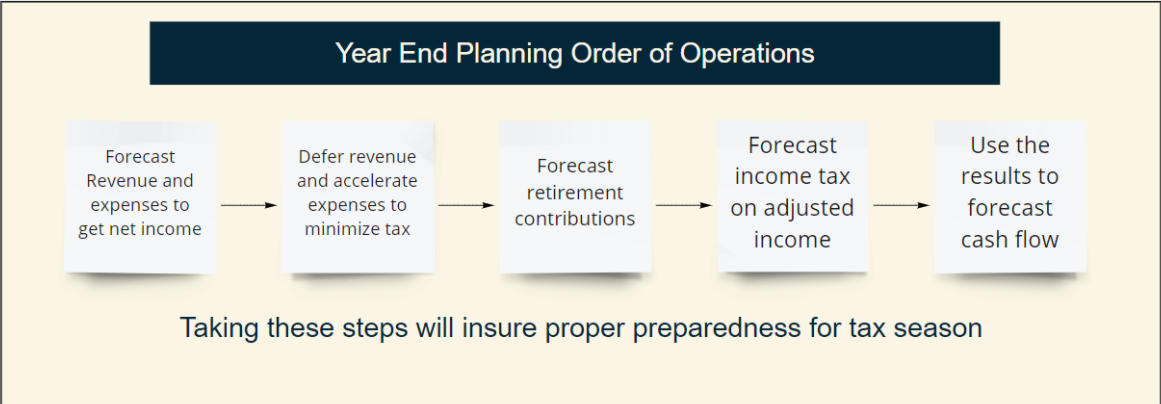

Planning for taxes before year-end is essential for many reasons. Ad Offers Comprehensive Explanations Of Topics Often Researched By Tax Professionals. Contact a Fidelity Advisor.

Other Tax Planning Strategies. Fast Reliable Answers. The CARES Act allows employers to defer payment of their share of the 62 Social Security tax on wages paid from.

Personal income above between 50271 and 150000 is taxed at 40. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Global events such as the pandemic are a.

End Your Tax Nightmare Now. These are just a few year-end tax planning strategies that could help you reduce your tax liability. Consider these year-end tax planning strategies to potentially reduce your taxes and help you achieve your long-term financial goals.

Income tax planning. Now is the time to take a closer look at tax planning strategies that could reduce your tax bill for 2021. Bridges CPA PFS December 2020.

In Taxes by Brandon Baiamonte MS CPA CFE CFM Director of Tax StrategySeptember 13 2022. 2 days agoEnd of Year Tax Planning Strategies. This year seems to have gone by.

Gifting is likely to become a more important strategy if the federal estate tax exemption drops from todays 117 million per taxpayer or 234 million per. End-of-year planning is essential for many reasons including tax planning philanthropic planning retirement planning etc. But tax day isnt the only important date for small business owners.

Capital gains are taxable at a rate thats dependent on your income and how long you held. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Pensions and charitable giving.

Proposed legislation may impact the tax on high-income taxpayers giving added complexity to year-end tax planning strategies. Tax laws and exceptions can change from time to time. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. Once the year is over the ability to reduce your taxes can be. Keep up with changes in federal and state laws.

Check out some of our related posts below and set. Year-end tax planning checklist. Year-End Tax Planning Strategies for 2022.

Ad 5 Best Tax Relief Companies of 2022.

5 Year End Tax Planning Strategies Investmentnews

Preparing For 2021 Tax Planning Strategies For Small Business Owners Abeles And Hoffman St Louis Cpas Business Advisors Ahcpa

Year End Tax Planning Strategies For Businesses

Year End Tax Planning 2020 Important Financial Tasks Not To Be Overlooked

Year End Tax Planning A Must Jewish Exponent

End Of Year Tax Planning Checklist

2019 Year End Tax Planning Individuals Roth Conversions Bethesda Cpa

Year End Tax Planning Strategies Wealth Management

Year End Tax Planning Tips Veterinary Practice Sva Cpa

S1e1 Moore On Manufacturing Top 6 Year End Tax Planning Strategies For Manufacturing

Year End Tax Planning Guide 2021 Aldrich Cpas Advisors

Tax Planning Strategies For Year End Tax Planning 2021 Corvee

Year End Tax Planning Strategies For Businesses Wegner Cpas

Webinar Recording Top 10 Year End Tax Planning Strategies